Our dedicated teams treat every loan and asset as if it were their own, infusing personal care and expertise into every interaction.

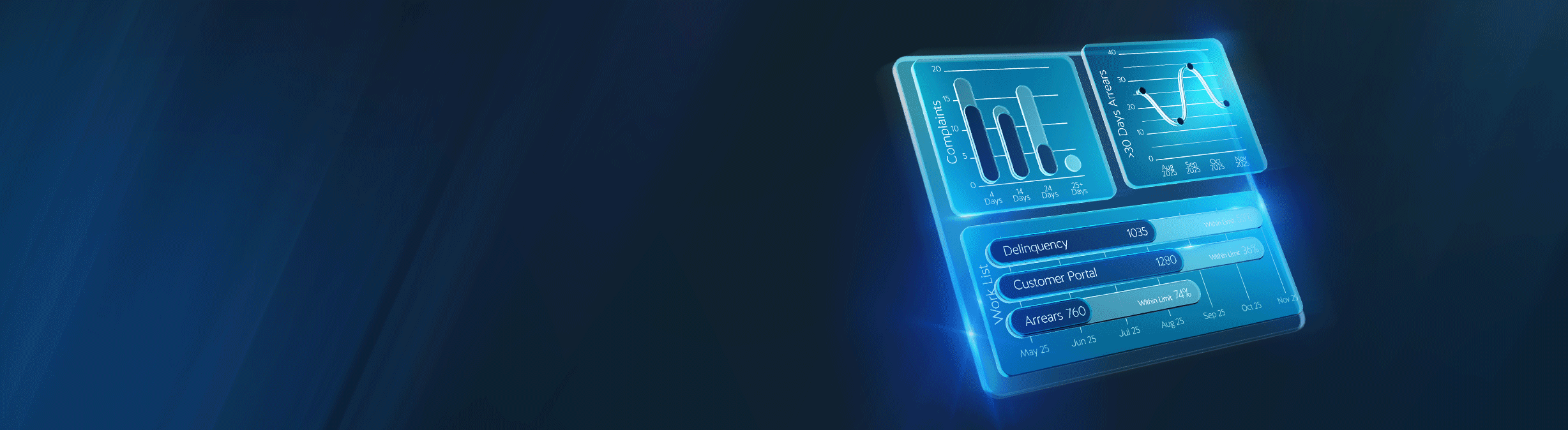

PRISM

Our proprietary platform that puts the power of automation, advanced analytics and real-time data in your hands.

Innovation in Lending Starts Here

A new era of digital-first loans, delivered by Clay and Pepper Advantage

Pepper Advantage to acquire Computershare’s UK Mortgage Servicing Business

Global credit intelligence

Pepper Advantage is your global partner for loan services, asset management and credit intelligence. We assist lenders and investors in managing credit portfolios and empower customers.

Valerie Doherty

Legal Administrator

Our technology

It’s not just support, it’s central to what we do. As a credit intelligence leader, we leverage technology and data platforms to offer matchless insights across all products and jurisdictions.

UK Mortgage Arrears Fall for Second Consecutive Quarter

Q3 2025 data shows that the improvement in the total arrears rate across Pepper Advantage’s UK portfolio seen last quarter has continued, with the arrears rate falling 0.3% compared to Q2 2025. This slight improvement was driven by a decline in the residential arrears rate, which fell 0.2% quarter-on-quarter. Direct debit rejections, however, grew 4.2%, in line with rising inflation.

/Web%20Page%20Banner.png)

We’re primed for the many challenges posed by today’s fluctuating markets. With global reach and locally focused teams, Pepper Advantage is redefining credit portfolio management. Our people-first approach, backed by the latest technology, ensures success across diverse asset classes and performance grades.

What we offer

Credit management

Credit technologies

Credit Gateway

Advantage Hub

Credit management

Effectively managing loans poses numerous challenges, from maintaining a strong workforce and the latest tech, to overseeing payments, arrears and collections through relationship management, and ensuring compliance with regulations. All of which demands valuable resources. By outsourcing to us, our clients enhance their investment performance, lower expenses and can concentrate on fostering core business growth.

Credit technologies

At Pepper Advantage, technology isn’t just a tool, it’s the heartbeat of our personalised approach. Our groundbreaking loan management system and custom data and analytics platform revolutionises decision-making and guides businesses through every phase of the loan journey, from application to collection and restructuring. Rich performance data and borrower insights empower our experts to optimise people’s financial futures.

Credit access

Our Credit Gateway unlocks opportunities for investors, providing access to prime opportunities worldwide. We facilitate investor access to diverse yields and credit assets across global markets through several channels, including direct portfolio investment, co-investment opportunities, and a comprehensive lending platform with origination and servicing capabilities.

Advantage Hub

This isn’t just another outsourcing solution – it’s your gateway to operational efficiency and scaling your workforce as needs evolve. Drawing from over a decade’s experience of providing back-office services, we’ve curated a team of top-tier professionals armed with the latest tools, and we deliver a full spectrum of offshore support services.

Trusted by leading brands

Pepper Advantage fuels success, enhancing lender value, pinpointing lucrative opportunities for investors and guiding borrowers towards their best path.

We help people succeed

Our business in numbers

Over a decade of exponential growth reflects our dedication to innovation, customer commitment and an unwavering pursuit of excellence.

As at April 2024

Assets under management (USD)

FUnding transactions

Countries

Institutional Clients

Asset classes

Portfolios

Loans managed

Our Advantage

Pepper Advantage pioneers data-driven credit management, optimising yields and operational efficiencies. We cater to diverse asset classes and are trusted by top global financial institutions for consistently positive returns and people-focused results.

Smart credit management

Our focus lies in the advancement of cloud-based smart technology aimed at optimising operations by leveraging automated workflows, robust data collection and analysis capabilities.

Multiple assets across all performance grades

We cover a wide spectrum of financial needs, from residential and MSME mortgages to corporate, personal and auto loans, credit cards, factoring, BNPL and real estate asset management.

Local relevance, global scale

Our approach combines modular services, rigorous governance, a history of strong returns and a lender’s perspective. We’re trusted by leading banks and financial institutions.

How we get people ahead

With a leadership team that has spearheaded operations from the start, we’ve built extensive industry ties and a solid reputation in regulated markets. Bolstered by local management teams in all our markets, we excel in advancing people responsibly, even in the most challenging markets.

Customer-centric approach

Our skilled and seasoned service agents handle customer queries with empathy, even in the most testing, complex situations.

Agile response

We use data and analytics to back emerging credit products and adapt to evolving credit preferences, ensuring we stay aligned with market trends and customer needs.

Accountable service

We prioritise corporate compliance and respect for regulatory frameworks in everything we do. It’s ingrained in our workflow and operating platforms, reflecting our commitment to integrity and responsibility.

Where customers and tech meet

Our process is comprehensive: from onboarding to problem-solving, adapting to client needs and managing portfolios as markets change. Our proprietary software handles multiple asset classes efficiently, tracking performance and trends.

Our globally expanding footprint

Pepper Advantage spans diverse geographies, asset classes and currencies.

Our locations

We have over 90 clients throughout India, Greece, Spain, Ireland, Fiji and the UK. We are market leaders in the UK and Ireland and are growing other European profiles, and we’re well positioned to take full advantage of growth in Asia.

United Kingdom

Established in 2013 with offices in London and Uxbridge.

Ireland

Established in 2012 with offices in Dublin and Shannon.

Spain

Established in 2013 with an office in Madrid.

Fiji

Established in 2022 as the first outsourcing centre under the Advantage Hub offering.

Greece

Following the acquisition of NAI Hellas in 2018, Pepper Advantage established its presence in Athens, Greece.

India

Established in 2019 with offices in Mumbai and Vellore.

United Kingdom

Established in 2013 with offices in London and Uxbridge.

Ireland

Established in 2012 with offices in Dublin and Shannon.

Spain

Established in 2013 with an office in Madrid.

Fiji

Established in 2022 as the first outsourcing centre under the Advantage Hub offering.

Greece

Following the acquisition of NAI Hellas in 2018, Pepper Advantage established its presence in Athens, Greece.

India

Established in 2019 with offices in Mumbai and Vellore.

Latest News

Cookie settings