Are you prepared for the stress? Tracking the economic storm

01 November 2022

As lenders and investors pass on rising interest rates over the coming months, all eyes will be on the underlying performance of borrowers.

The high proportion of residential borrowers currently insulated from recent changes by fixed rates may be keeping delinquencies low for the moment, but lenders and credit investors will be alert for signs of stress in their loan books and should be acting now to consider how they will track and respond to borrowers who find themselves in difficult positions.

Central to this will be actionable data that enables lenders and investors to pinpoint vulnerable groups before financial pressures hit repayments, allowing them to design solutions that protect consumers wherever possible. Developing such strategies supports consumers whilst preserving long term credit quality and thus, commercial value.

This type of useable data is exactly what we are working hard to bring to the market. In this article, we take a look at the overall macroeconomic environment and current consumer behaviour to provide some insight into where we at Pepper Advantage are seeing real-time signs of borrower stress emerge. This insight is powered by our global credit intelligence platform, which allows us to analyse the portfolios we manage in real time.

In our world, high quality data allows us to develop deeper and more coherent insights into what is going on beneath the surface. This helps us to identify risks as they begin to emerge and develop proactive solutions for borrowers before they run into difficulty. Put simply, data trumps anecdote.

It is with such rich credit intelligence that we help our clients proactively identify areas of stress, design proactive borrower strategies targeted in the right areas to mitigate this stress, and ultimately, ask more informed questions and make better lending and investing decisions.

Here is what we are seeing right now.

All quiet on the mortgage front?

Pepper Advantage manages more than 1 million retail loans, of which 400,000 are in the UK and Spain alone, affording us significant interaction with individual borrowers. In a year, we make close to 650,000 outbound calls, over 400,000 inbound calls and process nearly 4.6 million payments for a range of borrower and product types. We are therefore on the front line of the current macroeconomic challenge, with a unique vantage point from which to analyse real-time consumer and payment behaviours across both markets.

In the UK, delinquency rates across our portfolios are currently stable, which is unsurprising and reflects not only the high proportion of borrowers on discounted fixed-rate deals[1] but also the savings that borrowers have built up through the pandemic, which has helped them to weather the macroeconomic storm since inflation began to tick up in mid-2021. Data indicates, however, that inflation is eroding these savings, which is beginning to flow into borrower behaviours. According to the Office for National Statistics, decreases in the UK Household Savings ratio since mid-2021, plus a recent dip in UK Consumer Spending for the second quarter of 2022, suggest borrowers are bracing for difficult times ahead.

As a result, when we dig deeper, the picture on the UK mortgage front is less reassuring.

One of the leading indicators of potential stress tracked by Pepper Advantage is Direct Debit Rejections (DDRs). DDRs are where a direct debit has been processed by the creditor, but payment has not been received, accepted, or settled into the creditor’s account. Most DDRs are the result of an insufficient fund balance at the time the direct debit was called. In some cases, a technical DDR can occur immediately post the migration of a loan portfolio, which is why we track >1 month post boarding DDRs alongside other indicators to determine whether there is any inherent risk emerging within the borrower base.

DDRs can occur for a variety of reasons, but in our experience they are a strong indicator of future stress particularly if >1 month post boarding DDRs occur consistently, increases in DDRs occur within similar borrower cohorts, and they are present alongside a declining Pay Rate. The interplay between these and other early warning indicators gives us a stronger picture of what is really happening in the market and is a key feature of how we manage early signs of arrears in our portfolios.

In the UK, DDRs have increased steadily through 2022 across our originated residential mortgage portfolios, with a material increase from April to September this year of +64% on a Rate of Change basis.[2]8

DDRs in our investor loan portfolios are up by 13.8% over the same period despite dipping in September.

Looking at direct debit rejections from April to September at across different products shows material differences in the performance of different product categories:

a. Fixed Rate: +75%

b. Variable: +34%

c. Tracker: +21.7%

d. Discount: +58.9%

Notably, customers on a fixed rate have seen a starker increase in DDRs than other groups, which is likely the result of the borrower profile of fixed rate mortgage holders. Pepper Advantage research indicates that those on fixed rates are generally more budget conscious and want the certainty that a fixed rate mortgage provides. Increases in core household expenses (particularly shelter, fuel, food and transport) are likely hitting these borrowers more than those on variable rates, who tend to have a better ability to absorb an increase in prices.

Another concern arises when you look at fixed rate borrowers whose terms expire in the next 0-12 months. For this cohort, DDRs have increased from Dec 2021 to Sept 2022 by 225%. This is in stark contrast to the increase in DDRs for fixed rate borrowers whose terms expire in 1-2 years and 2-3 years. Here we see an increase of 24% and 36% over the same time period, respectively. Lenders will be grappling with the decision whether to provide the option to re-fix the mortgage or automatically switch the borrower to a variable rate. Whichever the case, the financial impact will inevitably be felt by these borrowers given the higher level of interest rates now prevalent in the market.

Overall payment rates are also starting to trend down for UK mortgage originated loans, decreasing by 25.4% over the last six months from April to September 2022. This decrease is in stark contrast to the post Covid-19 trend, which showed a material improvement from mid-2020 as borrowers used a combination of mortgage payment holidays and higher personal savings to meet their repayments (and in many cases overpay).

Rising consumer borrowing in the UK supports our findings. According to the Bank of England, consumers borrowed an additional £1.4 billion in consumer credit in July 2022 alone, £0.7 billion of which was in the form of new credit card lending, as the cost-of-living crisis escalated. Growing demand for credit matched with falling payment rates and rising DDRs reinforce the picture that UK borrowers are vulnerable to financial pressures, and, as our early warning indicators suggest, we are only starting to see this stress trickle through our portfolios.

Spain

Turn our attention south to Spain and we see a similar picture: headline numbers suggest borrowers are currently insulated from interest rate rises, but a series of Pepper Advantage indicators are showing early signs of stress.

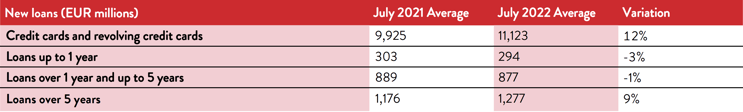

Starting with the consumer at a macro level provides helpful colour as to whether there is any stress in the system. According to Banco de España, the Spanish Central Bank, overall personal debt is on the rise here as well, with the level of certain types of consumer credit noticeably higher than last year.

Demand for credit cards and revolving credit has increased markedly by 12% from July 2021 to July 2022, and the same upward trend applies for unsecured loans with 5+ year term, which have increased by 9% over the same period.

This could imply that borrowers now need access to a revolving source of capital, or to borrow over a longer period, to allow them to fund their expenses. Interestingly, aggregate non-credit card debt is broadly flat over the first half of 2022; the mix of that debt, however, has changed substantially which implies borrowers are looking for a longer window within which to pay it.

Of additional concern is that Spanish consumer borrowers are accepting higher costs of debt for both credit cards/revolving credit and 5+ year term loans: the average interest rate for credit cards/revolving credit is 18.2% (broadly flat year-on-year) and 7.14% for 5+ year debt (an increase of 7.7% from December 2021 to July 2022).

This increase in aggregate debt load and debt serviceability cost is occurring as Consumer Non-Performing Loans (NPLs) are also on the rise in Spain. In March, Consumer NPLs hit ~7.5%, its highest level in nearly seven years.

Spanish consumers appear to be under demonstrable pressure, taking out loans to fund their lifestyles and pay their mortgages. However, Banco de España is not reporting a material increase in delinquency figures – at least not as of March 2022, which is the most recent publicly available data. But what has happened since then?

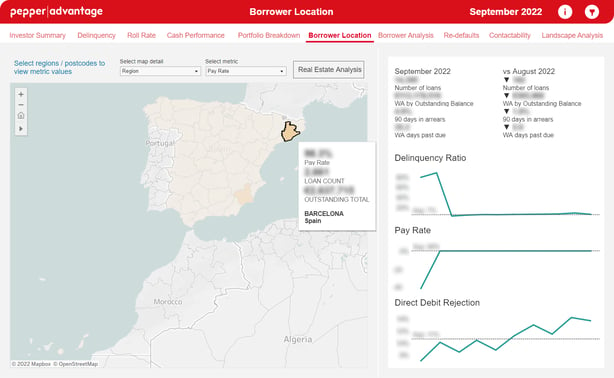

This is where we see the importance of the real-time data insights that can be generated from our credit intelligence platform, which show a very different picture beginning to emerge.

Warning lights flash underneath the hood

Much like the UK, this stress is not immediately obvious on the surface. Borrowers seem to be making payments, despite the macroeconomic backdrop. Pandemic savings and, in Spain, support from family (predominately parents) seem to be supporting overall payment levels according to data points we track.

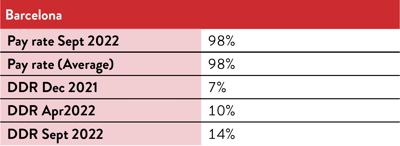

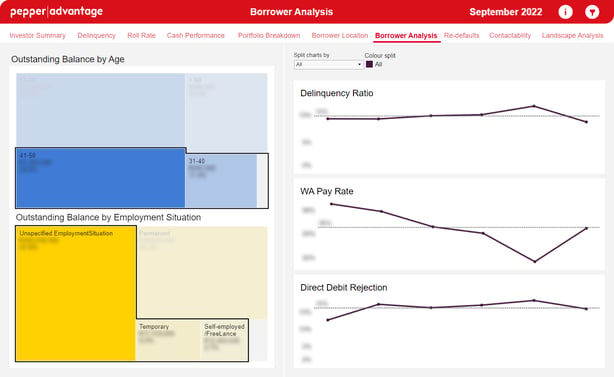

Zoom in by region and product type, however, and we see that there is significant variability that the headline figures do not capture. In Barcelona, for example, where the rate of DDRs has doubled even while the average payrate has remained relatively steady:

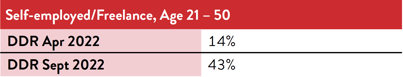

Critically, when you overlay age and employment type, you begin to see a wider level of stress across a very particular group: self-employed/ freelance/ temporary/ unspecified employment borrowers aged 21-50 have seen their DDR rate jump by 207% in the last six months:

We are seeing this specific datapoint emerge in similar borrower cohorts in other regions, but nowhere is it as stark as in Barcelona. Like in the UK, we are also seeing stress emerging in some of our other early warning indicators.

Holding back the tide

Looking at the charts below, we see that while there has been some volatility in delinquencies, they have not risen anywhere near the same extent as direct debit rejections during this period, and when they have increased, they have come back down to the rolling six month average quicker.

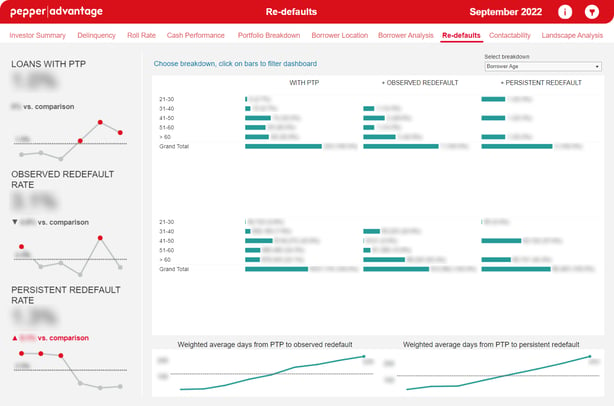

Notably, we are not yet seeing this stress evidence itself in other areas. The overall repayment rate has remained more or less flat and, as can be seen in the chart below, we see no rise in re-default activity. Indeed, while loans with a Promise to Pay (PTP) remain unchanged, observed re-defaults (1 missed payment after a PTP) and persistent redefaults (>1 missed payment after a PTP) are below average.

We are not yet seeing this stress roll-through to re-default activity for the same cohort of borrowers, suggesting that this issue is an emerging one and not inherent to this borrower cohort. This is not because there isn’t stress in the borrower base, but rather because borrowers are keeping their heads above water through savings, short term borrowing and support from family. Ultimately, this stress has yet to work its way through the system.

We are seeing borrowers in this cohort with a Promise to Pay increasing, although it should be noted that this is off a relatively low base. While it is a key data point to focus on, an important observation is that while the rate of Loans with a PTP is slightly elevated, Observed Redefaults and Persistent Redefaults[3] are currently trending below their rolling six-month average, which highlights the importance of having a proactive set of restructure products available. We effectively re-underwrite these borrowers to assess affordability/serviceability and seek to put them on new payment schedules which, over time, become reperforming loans if they adhere to their payment obligations. We also employ dynamic contact strategies supported by advanced calling analytics to ascertain any residual stress borrowers on a PTP may be under so we can take alternative actions as required.

The fact that macroeconomic stress is very much in the early stage and has yet to manifest in significant levels of unemployment coupled with the proactive approach we take with loans on a PTP has resulted in an increase in the Weighted Average (WA) Days from both PTP to Observed Redefault and PTP to Persistent Redefault, meaning fewer borrowers in this cohort are falling into arrears, and those that do are taking longer to redefault. This data is not surprising given the pay rate and arrears data highlighted. We do not expect this trend to remain should inflation pressures persist.

Further indicators of credit risk inherent in the portfolios we manage irrespective of product type, borrower type, or location are also available to us.

The charts below indicate the low level of borrowers within this cohort who have a PTP, how few of them are rolling into subsequent repayment stress and, at present, the significantly longer time for PTPs to redefault. Furthermore, the dynamic stratification (“strat”) table currently illustrates the PTP performance against borrower age, however it can be dynamically stressed against eleven different variables indicating where redefault risk sits within the borrower cohort.

The question to ask at this stage is what is driving this anomaly? In other words, why are DDR rates up substantially yet core performance metrics are flat or improving? One significant factor is that the impact of underlying macroeconomic conditions on borrowers is only beginning to emerge. Another is the fact that the Covid-19 pandemic era of savings, family support and short term debt is keeping issues at bay for the moment, but the overall answer is more nuanced.

In our next blog, we will take a closer look at how the insights we discuss here have been integrated into technology-driven workflows that help everyone – lenders, investors, credit managers and borrowers – navigate the current environment, resulting in better core performance metrics.

As the data above demonstrates, we are seeing the power of having a proactive, tailored, and scalable credit management solution that gets ahead of and identifies issues before they emerge. The right data in the right platform allows us to identify cracks as they appear in real-time. Drawing on granular data that tracks behaviour across product types, age, region, and employment type means we can pinpoint shifts, trends, and early signs of trouble. We are building these insights into our global credit intelligence platform, where they will be a key part of the service we provide to clients.

It is worth noting that there are no silver bullets in today’s economic environment, only information. As more borrowers who are currently insulated from rising interest rates reach the end of their fixed terms, or as household incomes come under pressure to the point they cannot sustain their various obligations, the more this information will be needed.

[1] According to UK Finance this is as much as 75% of the 9 million residential mortgages outstanding.

[2] Percentage change in DDRs during an observed time period.

[3] Observed Redefault = a loan with a PTP that has had ONE missed payment but then recovered, Persistent Redefault = a loan with a PTP that has had TWO or more consecutive missed payments

Disclaimer

The material contained in this Article (the “Material”) has been prepared by Pepper Global Servicing Investment 1 Limited (“Pepper”).

No representation or warranty, express or implied, is or will be made with respect to the accuracy, completeness, usefulness or merchantability of the Material or its fitness for a particular purpose or regarding the accuracy of the assumptions or the output or the appropriateness of the parameters used in the calculation of any projections or estimates set out herein or the correlation of the data to the actual or expected performance and characteristics of any transaction and no liability or responsibility is or will be accepted by Pepper or any of its affiliates or associated companies or any of their respective directors, officers, employees or agents in relation thereto. Any use of the Material by the Recipient for any purpose whatsoever will be entirely at the Recipient’s own risk.

This Material may utilise information which has not been independently verified and may include that from public sources and third parties (including market and industry data). Further, this Material may contain forward-looking statements, estimates, forecasts and projections that may be affected by inaccurate assumptions, expectations and estimates and by known or unknown risks and uncertainties are predictive in character and inherently speculative and may or may not be achieved or prove to be correct. The Recipient should not place reliance on such statements.

By accepting the Material, the Recipient acknowledges that (a) Pepper is not in the business of providing advice including legal, tax or accounting advice, (b) there may be financial, legal, tax or accounting risks associated with any transaction, (c) it will seek advice from advisors with appropriate expertise to assess relevant risks and independently determine, without reliance upon Pepper, the economic risks and merits of any transaction and that it is able to assume any such risks and that (d) nothing herein shall form the basis of or be relied on in connection with any contract or commitment whatsoever and neither Pepper nor any of its agents accept liability for any loss howsoever arising, whether direct or consequential, from, related to or in connection with any use of the Material or otherwise arising in connection herewith.

Your receipt and use of the Material constitutes notice and acceptance of the foregoing.

Most read

J.C. Flowers Acquires Pepper Advantage from Pepper Global

Pepper Advantage to Acquire Computershare’s UK Mortgage Servicing Business

Pepper Advantage will manage Servicios Prescriptor y Medios de Pagos loans

Pepper Advantage Announces Closure of Acquisition by J.C. Flowers to Fuel Company’s Next Growth Phase

Prism: Powering the Future with Innovation, Data, and Customer-Centric Technology

Cookie settings