UK Finance Data Echoes Pepper Advantage Credit Report, Signalling a Difficult Winter Ahead

01 December 2023

As the leaves fall and the nights draw in, recent data from UK Finance and Pepper Advantage's own Q3 UK credit intelligence report paint a stark picture of the challenges facing the UK mortgage market this winter. The convergence of these reports signals a period of heightened financial stress for borrowers, landlords, and financial institutions alike.

The Current Landscape

UK Finance's latest data reveals a 7% quarterly increase in homeowner mortgages in arrears, with buy-to-let mortgages also experiencing a significant uptick. This trend mirrors Pepper Advantage's report last month, which highlighted a post-financial crisis high in arrears within its portfolio. These figures are more than just statistics; they represent real households grappling with economic pain.

The Macro-Economic Context

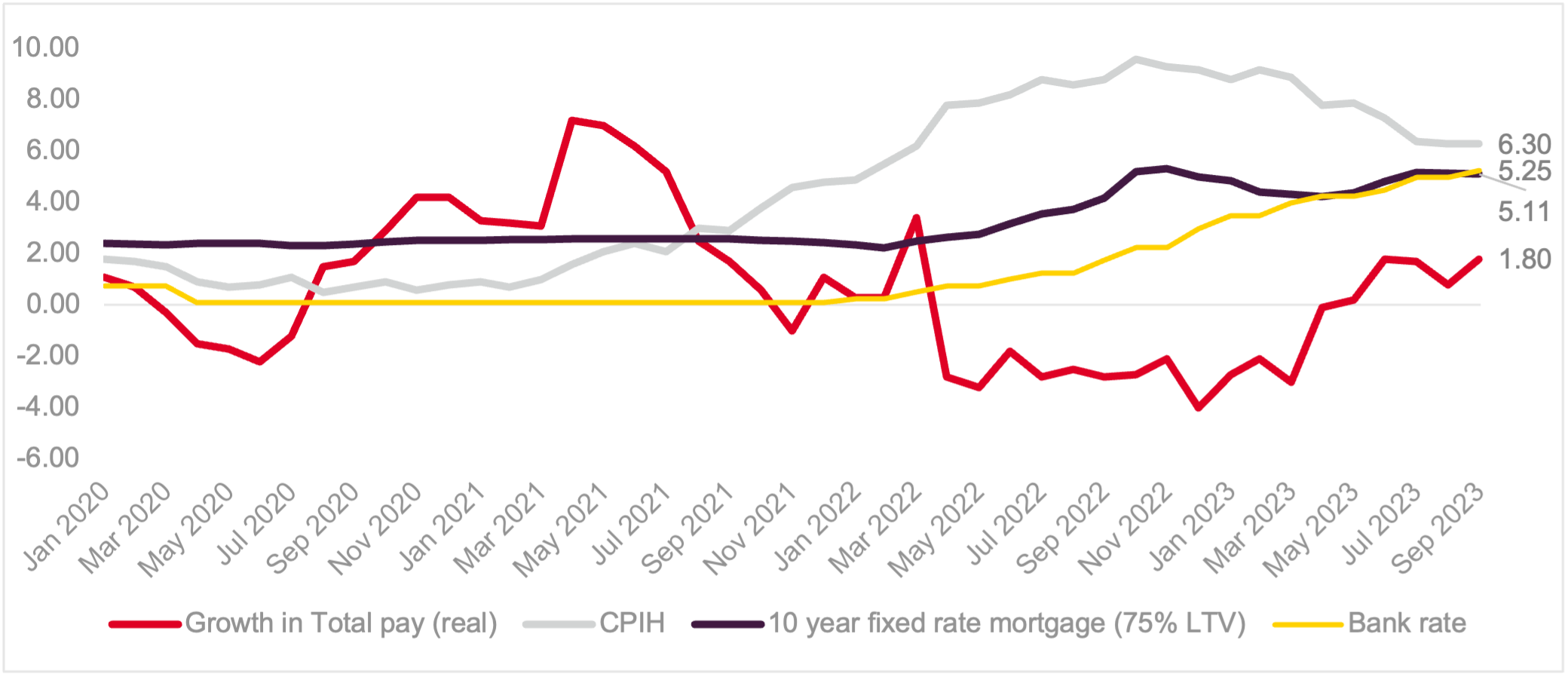

Despite a recent dip in the UK inflation rate to 4.6%, relief for borrowers may be slow to materialize. Even with recent improvements in short-term wage dynamics, real wage cuts over the past two years (as seen in Fig. 2 below) have eroded the financial resilience of many, leaving them vulnerable to even minor economic shifts. There is also a lag in the positive impact of falling inflation on household budgets, which means that many will still feel the pinch of the cost-of-living crisis for months to come.

The economic concerns are further underscored by messages from events like the National Institute of Economic and Social Research’s UK Economic Outlook Autumn 2023 Forum. The slow recovery from distributional shocks and the stark contrast in real wage growth between low and high-income households are alarming. A higher proportion of income being spent on elevated energy, food, and housing costs exacerbates the challenges. Living standards for those in some lower income deciles are not expected to return to pre-pandemic levels until the end of 2026. Real household incomes are indeed growing more strongly in 2023, but the most significant fall in real wages occurred for the poorest in 2022. This paints a concerning picture of a prolonged struggle for those in the lower income brackets, underscoring the urgency of targeted interventions to address the widening fault lines of inequality.

For mortgage holders, particularly those who secured mortgages during the low-rate period of 2020-2022, the current interest rate environment remains high despite a recent pause in rate increases. The chart below shows the potential storm of financial difficulties the UK could face in the months ahead.

Fig. 1: Climbing Mortgage Rates vs. Minimal Growth in Total Real Pay Amidst a Cooling, High-Inflation Environment

Source: ONS, BoE

Regulatory and Legislative Changes and Their Implications

In addition to the challenges posed by the current economic climate, recent legislative changes, such as the Financial Conduct Authority's new Consumer Duty rules, are reshaping the credit management and loan servicing landscape. These rules require financial services firms to prioritise good outcomes for retail customers, focusing on clear communication, fair pricing, and supportive service. Pepper Advantage has proactively adapted to these changes, aligning our processes with these standards. Our commitment to customer-centric service and regulatory compliance is reinforced by our strategic use of technology and data analytics, ensuring we thrive in the new environment.

The inclusion of the Renters (Reform) Bill in the King's Speech is also a significant development. Although primarily focused on tenant rights, its implications ripple outwards, affecting landlords, banks, and loan servicers. The abolition of 'no-fault' evictions could push more landlords into managing non-compliant tenants, elongating the process and, as a result, impacting the cash flow and risk profiles of rental properties. This legislative shift necessitates a re-evaluation of investment strategies in the residential rental sector and operational realignments.

Navigating the Challenges

In this complex landscape, what options do borrowers under financial stress have? Pepper Advantage works with borrowers to find solutions most suitable for them. Below we share some best practice tips for people who are worried about their finances:

- Plan ahead: Planning can be daunting for borrowers, but it’s an important first step. Putting together a budget and making use of free mortgage calculators can people fully understand their financial situation.

- Speak with lenders: If borrowers are worried, they should contact their lender as soon as possible with an open, transparent rundown of their financial situation. It is important to share all relevant financial information, which will help the lender identify what strategy can best support a particular circumstance.

- Evaluate options: Thankfully, numerous strategies exist that can help borrowers in the short, medium, and long term, including term extensions, payment holidays, or temporary switches to an interest-only mortgage. Mortgage holders can talk through these options with their provider.

- Speak with a Debt Advisory Counsellor: A debt advisory counsellor can help borrowers assess their options, create a budget and develop a plan to help manage through this period.

- Be persistent: It may take some time for borrowers to identify a solution that works for them but continuing to work with lenders and/or a debt advisory counsellor and being prepared to make changes, such as cutting back on expenses in areas such as discretionary spending, will help borrowers regain firmer financial footing.

Conclusion

As we brace for a challenging winter, the data from UK Finance and Pepper Advantage underscores the challenge facing both borrowers and those managing credit assets. The evolving regulatory and legislative landscape, coupled with the macroeconomic pressures, calls for a nuanced and compassionate approach to managing credit portfolios, especially when those portfolios include loans for borrowers who may be struggling.

At Pepper Advantage, our commitment to borrowers remains steadfast as we navigate these challenging times alongside our clients and their customers. We continue to invest in technology and data that will help us derive insights and gain operational efficiencies that will allow us to support our clients through this period. The road ahead may be difficult, but with the right strategies and support, we can weather the storm together.

Most read

Cookie settings