Clay and Pepper Advantage Form Strategic Joint Venture to Power the Next Generation of Lending Startups

24 January 2024

- Joint Venture will see Clay’s Brandable Credit™ Platform integrated with Pepper Advantage’s proprietary loan management and data analytics platform

- Pepper Advantage invests seed funding; investment and joint venture will transform the fintech sector by providing a single, integrated platform that allows UK companies to launch their own lending programmes, addressing the significant challenges of loan origination, loan servicing compliance, technology and debt funding

London, 24 January 2024: Clay Technologies, Inc. ("Clay"), a platform that helps tech-enabled businesses launch and fund their own branded lending programmes, today announced it has secured a strategic seed investment from Pepper Advantage, a leading global credit intelligence company. The two firms have also formed a strategic joint venture that will create an end-to-end credit platform that allows companies to launch comprehensive and bespoke lending offerings to customers.

Many businesses, including fintechs, start-ups, and large corporate enterprises, are looking to launch lending programmes to drive business growth. These firms want to offer their customers access to credit, such as personal loans, credit cards, or invoice factoring, to help fund everything from home improvements and automotive costs to assisting in consolidating and refinancing higher-interest debts. Their ability to launch a successful credit offering is filled with significant challenges, such as raising debt capital, ensuring regulatory compliance, and constructing effective credit servicing and infrastructure. This process can stretch over years, with businesses facing costs that are often prohibitive.

Clay co-founders David Yalland (CEO) and Andres Castano (CTO) know firsthand the challenges fintechs face as a result of building Updraft, a fintech lender founded by Yalland that has successfully secured over $500 million in debt and equity financing. Their direct experience to these challenges as they built a new credit offering motivated them to develop Clay, a solution aimed at simplifying the process for any company with a lending vision.

Clay is a SaaS platform and API that empowers any company to launch their own Brandable Credit™ programme. A standout feature of Clay's offering is its Debt-as-a-Service, which provides clients with integrated access to funding for their loans. This eliminates the need to seek external debt capital providers and significantly reduces the complexity and time involved in launching a lending offering.

With just a few lines of code, Clay manages origination, underwriting, compliance, and servicing, all within a client’s app, without the need to redirect users to a third-party. This allows clients to prioritise front-end development and growth, while leaving Clay to manage the heavily regulated back-end processes.

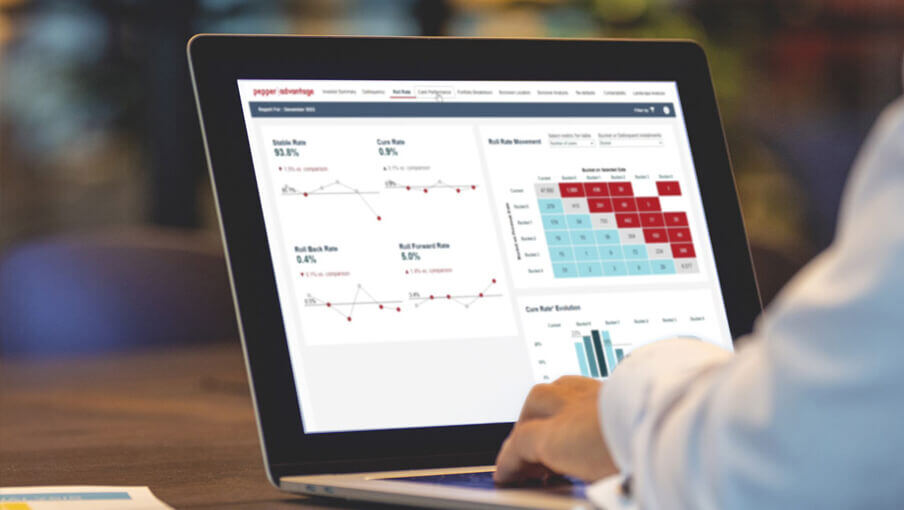

This capability is realised through Clay's pioneering work with Pepper Advantage. Under a new joint venture, Clay's platform is being deeply integrated with Pepper Advantage's Loan Management Platform, which will be the driving force behind Clay's comprehensive loan servicing APIs and will ensure loans are successfully managed from the moment of disbursement through to final repayment. Pepper Advantage will also provide advanced credit data analytics, offering Clay clients stronger insights and risk analysis across their entire credit portfolio.

With an impressive track record of managing over $55 billion in assets across nine jurisdictions spanning the UK, Europe, and Asia Pacific, Pepper Advantage adds substantial market credibility and loan servicing abilities to Clay’s platform. Customers of Clay will have confidence that the loans they originate will be effectively managed by Pepper Advantage, even if their loan book reaches several billion dollars.

David Yalland, Founder and Chief Executive Officer at Clay, said:

“We understand the hurdles companies of all sizes face in offering embedded credit products — from dealing with fragmented service providers to navigating the tough road of accessing debt capital markets, particularly as banks and debt funds often shy away from early-stage lenders. Our joint venture with Pepper Advantage, forming the foundation of our comprehensive platform, will significantly streamline the process for these companies to introduce their own branded offerings.”

Fraser Gemmell, Chief Executive Officer at Pepper Advantage, said:

“Our joint venture with Clay fits Pepper Advantage’s strategy of driving innovation within the lending sector. We continue to develop proprietary credit management technologies and advanced data and analytics to increase efficiency and expand credit access to clients underserved by traditional lenders. Clay’s platform will help companies access the capital, technology, and service offering they need to provide smart credit to their customers. We are proud to be part of this transformative offering.”

For media inquiries, please contact:

press@clay.so

PepperAdvantage@eternapartners.com

About Clay Technologies, Inc.:

Clay Technologies, Inc. empowers tech-enabled businesses to launch and fund their own branded lending programmes, providing a complete lending stack and debt line through a single platform and API. With just a few lines of code, Clay manages origination, underwriting, compliance, and servicing, all within the partner's app. https://www.clay.so/

Most read

Cookie settings