Press Release: New Data Shows Q1 UK Mortgage Arrears Growth Slows to Lowest Since Mini-Budget

30 July 2024

- Rate of UK arrears growth slowed to 3.9% in Q1 2024 from 5.7% in Q4 2023; lowest quarterly growth rate since Sept 2022 Mini-Budget

- North East and North West are the only regions in which arrears growth rate increased

- Failed mortgage payment rate, a leading indicator of borrower stress, falls

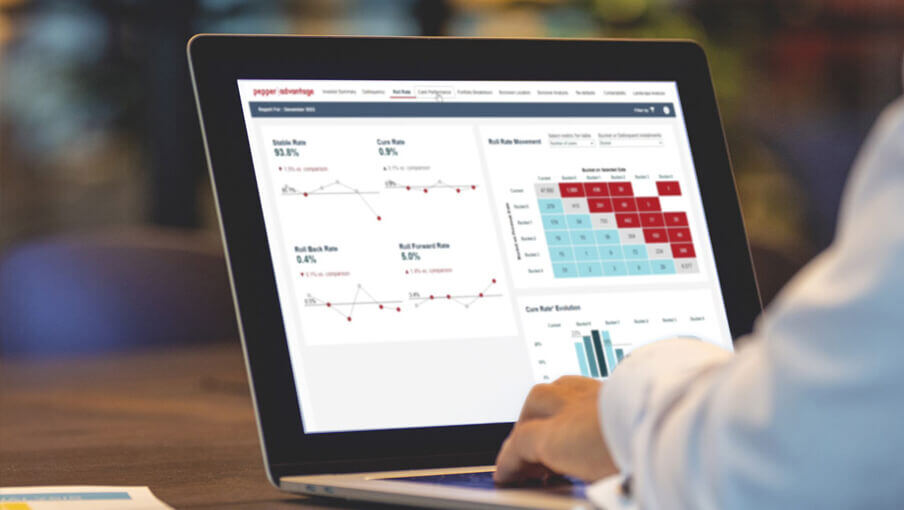

London, 29 April 2024 – Pepper Advantage, a global credit intelligence company, today published data on its portfolio of over 100,000 UK residential mortgages that shows the rate of mortgage arrears1 growth slowed in Q1 2024 to its lowest rate since Q4 2022, when the combined effects of the cost-of-living crisis and the September 2022 Mini-Budget began to impact UK household budgets.

The percentage of mortgages in arrears across Pepper Advantage’s UK portfolio grew by 3.9% in Q1 2024 compared to Q4 2023. This figure compares to a quarterly growth rate of 5.7% in Q4 2023 and 7.0% in Q3 2023. While the rate of arrears growth has slowed, the absolute rate of arrears remains at the highest level since 2008.

Other key findings from Pepper Advantage’s analysis include:

- Northern arrears growth disparity: The North East and North West of England were the only UK regions in which the rate of arrears growth increased, while the West Midlands and East Anglia showed the lowest growth rates of only 0.4% and 0.5%, respectively. The South East, South West and Greater London had the lowest absolute arrears rates in the UK, while the North East, North West, and Yorkshire and Humberside had the highest.

- Older age groups have the highest absolute arrears rates: Homeowners aged 60+ and 51-60 saw the first and second highest levels of arrears respectively, followed by those aged 41-50. However, every age group saw lower growth in the arrears rate in Q1. This trend was particularly noticeable for mortgages owned by people aged 31-40, which grew by only 0.1 percentage points quarter-on-quarter, possibly due to a combination of stabilizing inflation and healthy wage growth.

- Direct Debit Rejections2 decline in Q1: The percentage of residential mortgages that experienced a direct debit rejection (DDR) fell 2.3% in Q1 2024 compared to Q4 2023. This is the first quarterly decrease since Q2 2023 and breaks the trend of DDRs typically increasing following the December holiday period.

Aaron Milburn, UK Managing Director for Pepper Advantage, said: “While the slowing growth in the rate of arrears and lower direct debit rejections are welcome news for lenders and borrowers, the picture remains complex, and the overall level of arrears is still the highest since the 2008 financial crisis.

“The slowing growth suggests an increasingly resilient UK economy as lower inflation and higher-than-expected wage increases alleviate pressure on household budgets in some areas. However, the disparity seen between regions and age groups shows that financial challenges are not evenly spread. The Q1 data contains some hopeful indicators, but it is too soon to say if these trends will continue into Q2. Managers and lenders must be cognisant that some groups remain under pressure and will likely require support for some time.”

- Mortgages in arrears are defined as those that are 30+ days delinquent in payment.

- A direct debit rejection is a form of missed mortgage payment that typically occurs due to insufficient funds when a direct debit is called and is an early indicator of borrower stress.

Follow on LinkedIn.

Media queries

PepperAdvantage@greentarget.co.uk

+44 (0)7515 586 502

Most read

Cookie settings