Pepper Advantage passes £20 billion in UK assets under management

25 October 2022

3 min read time

- Global credit intelligence provider and specialist loan-servicer, Pepper Advantage, has passed £20bn in UK assets under management (AUM) reflecting strong growth in demand for its services

- Following the award of new mandates, the business is investing in its office in Skipton, North Yorkshire to create a specialist hub to support borrowers with financial difficulties

London, 25 October 2022 – Pepper Advantage, a global credit intelligence company, has exceeded £20 billion in UK AUM for the first time, reflecting growing demand from lenders for specialised loan servicing and portfolio analysis as credit markets tighten.

Pepper Advantage is the UK’s leading credit management servicer in organic origination. The company works with many of the country’s largest banks and mortgage lenders, such as NatWest, Metro Bank and Starling Bank, in addition to leading non-bank and fintech businesses as well as private equity investment groups.

Pepper Advantage UK manages 200,000 mortgages across a variety of asset types including residential, buy-to-let, second charge and small commercial real estate loans, as well as commercial loans. It handles 350,000 calls from borrowers per year across inbound and outbound, with needs ranging from routine administrative queries to more complex cases where customers need advice and support on meeting their loan payments. Following the award of new mandates, Pepper Advantage is taking advantage of the talent pool for financial services in North Yorkshire to invest in its site in Skipton, creating a specialist hub to support borrowers with financial difficulties. The business is also looking to expand its capacity further with hubs at other locations as the business grows.

Gerry McHugh, Chief Executive Officer, Pepper Advantage UK said:

“An estimated 1.8 million people with fixed rate mortgages will be forced to refinance their borrowings next year, with a huge impact on mortgage affordability given recent rate rises. As the cost and complexity of managing these loans inevitably rises, Pepper Advantage UK is the first choice for loan originators given the experience of our people and the investment we have made in proprietary systems and software.”

Fraser Gemmell, Chief Executive Officer, Pepper Advantage said:

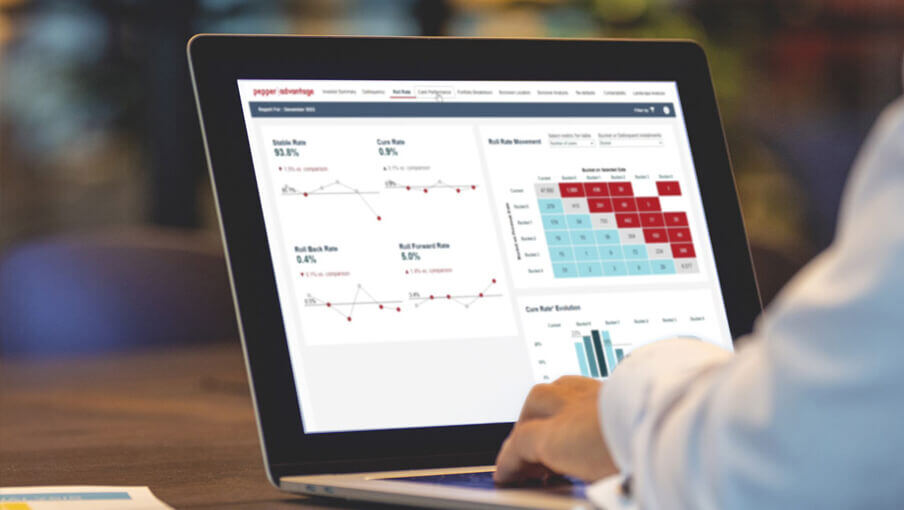

“We have made a substantial investment in developing a credit intelligence platform which provides real-time data, tracking and insights on the performance of loan portfolios, which we will be piloting with a number of UK clients in December. By identifying areas of emerging risk, our clients can develop solutions for vulnerable customer groups before they might be required.”

Pepper Advantage entered the UK market in 2013 and will celebrate the firm’s 10-year anniversary next year.

For all media queries please contact

Eterna Partners

PepperAdvantage@eternapartners.com

+44 07375 288 641

Most read

Cookie settings