Why it’s time to revolutionise credit management

12 April 2022

Pepper Advantage is certainly generating interest. When we announced our major transformation in late March, the market response was clear – we’d tapped into a genuine need and a hunger for change.

The market we operate in is changing dramatically. The challenges presented by Covid-19, persistent inflation, increasing cost of living and rising interest rates require a different, more proactive and sophisticated credit management approach. There are also more nuanced challenges facing the market. Financial institutions, with legacy and underinvested technologies, can no longer keep up with customer expectations, manage complex regulatory regimes, or invest in the technology needed to support ‘non-core’ areas of the business like non-performing loans (NPLs).

There are several mega trends shaping global financial services, where technology, data and analytics hold the key. In this update, we'll take you through three compelling changes that we believe highlight why it’s time to revolutionise credit management. And why Pepper Advantage is so well placed to do this.

Trend #1 - Shifting customer expectations

Around the world, consumers increasingly see their bank as an app, not a building. And as software, commerce and financial services continue to converge, so does consumer behaviour. When the pandemic triggered an online shopping boom, it created a 62% uplift in Buy Now Pay Later growth.

And that’s just one example. The rise and rise of alternative credit providers have left traditional lenders scrambling – and very few have invested in the ‘back end’ of the customer journey. In many financial institutions, the management of post-completion activities (including how customers in difficulty are managed), are largely tech-deficient – yet customers still expect (and need) personalised experiences.

This is especially true for the next generation of consumers. Generation Z wants to be treated as individuals, with automation and app functionality helping them manage financial difficulty – without the stigma.

Trend #2 - Banks choose scope over scale

As banks look to fintechs to help them meet these changing customer needs, they are more likely to find success by building a better ecosystem – not a bigger bank.

Delinquencies and defaults are part of any risk-based approach to credit – in Europe we see around €100billion in new ‘core’ NPLs created ever year, and this would be at least as large across Asia. However, banks are under pressure to reduce NPLs on their balance sheets. And as COVID moratoria are relaxed and the number of ‘online-only credit checks’ and other fintech products grow, the number of stressed loans may increase globally. These will need to be managed carefully.

At the same time, investors are on the hunt for yield – further increasing the volume of capital in the market.

These factors will create significant demand for a global, scalable, and consistent credit management solution – for Pepper Advantage, and our unrivalled data and analytics capabilities.

Trend #3 - ‘Bionic’ credit management is now possible

Technology is the enabler of these fundamental shifts in the global financial markets. Advanced analytics and algorithms have the potential to destigmatise and personalise the credit experience, and provide predictive insights to mitigate risk.

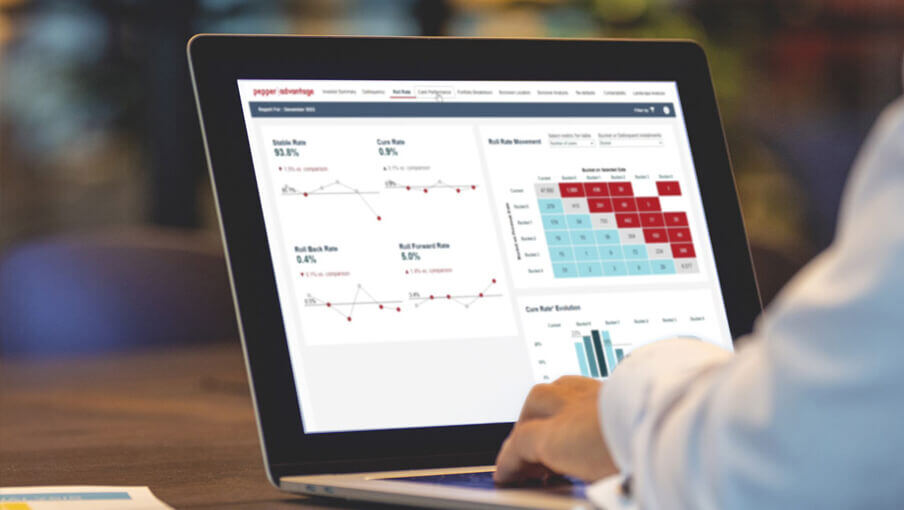

With our growing capabilities and array of data and analytics tools, we will help our partners focus on future portfolio risks and opportunities – not just historic and static reporting. Turning data into insights that improve performance and customer experience.

A distinctive market advantage

Understanding these shifts is core to the customer focus pillar of our strategy. It shows we are listening and helping them achieve their financial goals while also meeting regulatory requirements.

We know regulation is here to stay, and will only become more pervasive. Our platform will unlock a core differentiator for Pepper Advantage – the transparency and accuracy regulatory regimes require.

When we talk to our partners, it’s clear this industry is ready to embrace change. To create better products, to develop better risk management capabilities, and to meet the needs of the next generation of consumers.

The revolution is underway, and we are leading the charge.

Most read

Pepper Advantage obtains Indonesian licence to service non-bank credit providers

Pepper Advantage gestionará en España una cartera de préstamos con más de 2 millones de cuentas para una Firma Internacional de Private Equity

Pepper Advantage Spain to manage former Servicios Prescriptor y Medios de Pagos loan portfolio of 2+ million accounts for international private equity firm (Clone)

Embracing Technology: Pepper Advantage's Strategic Use of AI to Enhance Borrower Outcomes

UK Macroeconomic Snapshot - A mixed outlook remains

Cookie settings